From Idealpos 7.1 Build 13 and onwards, Tax Amounts are included in the data that is exported to the CHARGES.DAT file.

This enables Newbook to receive data that contains information on whether or not the Item includes Tax, as well as the Tax amount included for the item.

There is no configuration required to enable this functionality, other than ensuring the Tax Rates are configured in Setup > Global Options > Sales > Tax Rates and also ensuring that the individual Stock Items have the applicable Tax Rates enabled as required.

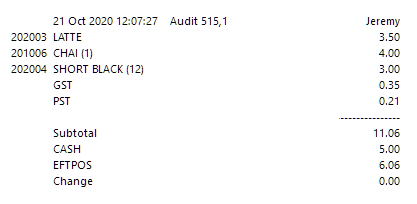

As an example outlining the Tax Amounts function which gets posted to the CHARGES.DAT, please see below:

Journal Enquiry (Enquiry > Journal History)

Note the LATTE is tax free, the CHAI has tax 1 and the SHORT BLACK has tax 1 and 2.

Also note that the second-last field is only 1 if it is tax-free, the last field is the total tax for that department.

This is the resulting CHARGES.DAT file:

CHARGE,0,CASH SALE,TEA,,1,4.00,1,21/10/20 12:07:27,0,0.20

CHARGE,0,CASH SALE,COFFEE,,1,3.00,1,21/10/20 12:07:27,0,0.36

CHARGE,0,CASH SALE,COFFEE,,1,3.50,1,21/10/20 12:07:27,1,0

PAY,0,CASH SALE,CASH,,1,5.00,1,21/10/20 12:07:27,1,0

PAY,0,CASH SALE,EFTPOS,,1,6.06,1,21/10/20 12:07:27,1,0

Idealpos supports Tax Inc and Tax Ex (USA region) so that Newbook can distinguish between Tax Inc and Tax Ex.

There is no configuration required to enable this functionality, other than ensuring the Tax Rates are configured in Setup > Global Options > Sales > Tax Rates, ensuring that the individual Stock Items have the applicable Tax Rates enabled as required as well as having your region set to a region which supports Tax Inc/VAT (ability to have tax added onto the item when the item is added to the sale and you go to the Tender screen).

Examples that outline how Tax Inc/Tax Ex data will be exported to Newbook are outlined below:

In the below examples, Items which show (1) next to the item indicate that the item is Ex Tax and Items which show (2) next to the item indicate that the item is Inc Tax.

Example 1 - One Item Inc Tax:

Idealpos Journal/Receipt:

The resulting output sent to Newbook in the CHARGES.DAT file shown below:

CHARGE,0,CASH SALE,Beverages-Taxable,,1,10.00,1,03/03/21 12:50:31,0,0,0.70

PAY,0,CASH SALE,CASH,,1,10.00,1,03/03/21 12:50:31,1,0,0

Example 2 - One Item Ex Tax:

Idealpos Journal/Receipt:

The resulting output sent to Newbook in the CHARGES.DAT file shown below:

CHARGE,0,CASH SALE,RV Supplies,,1,10.00,1,03/03/21 12:50:44,0,0.75,0

PAY,0,CASH SALE,CASH,,1,10.75,1,03/03/21 12:50:44,1,0,0

Example 3 - One Item Ex Tax & Two Items Inc Tax:

Idealpos Journal/Receipt:

The resulting output sent to Newbook in the CHARGES.DAT file shown below:

CHARGE,0,CASH SALE,RV Supplies,,1,10.00,1,03/03/21 12:52:09,0,0.75,0

CHARGE,0,CASH SALE,Beverages-Taxable,,2,20.00,1,03/03/21 12:52:09,0,1.40

PAY,0,CASH SALE,CASH,,1,30.75,1,03/03/21 12:52:09,1,0,0